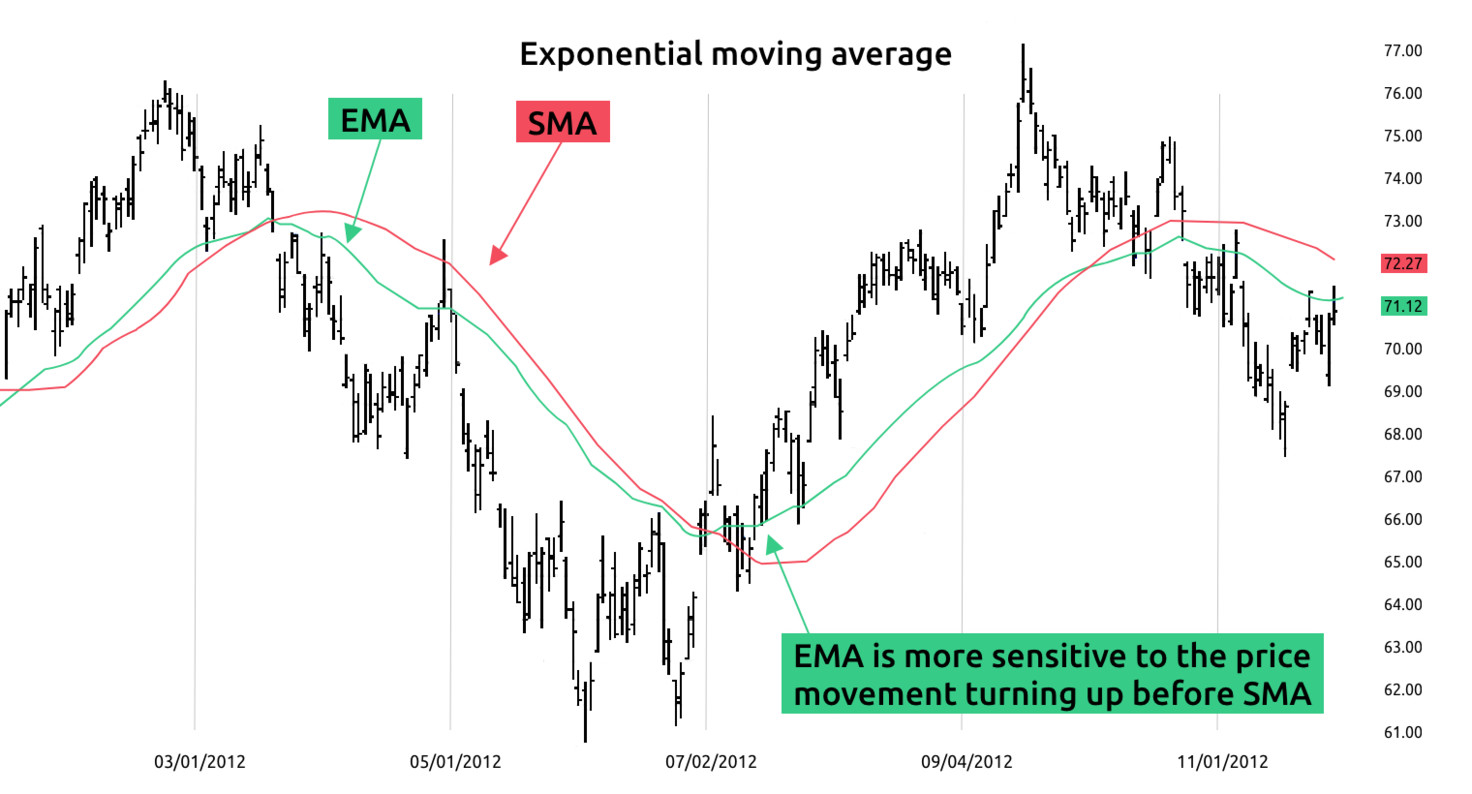

One can use these two indicators for any index/stock and check.Ī Death crossover is a technical analysis indicator that occurs when a short-term moving average (50-day moving average) crosses below a long-term moving average (200-day moving average). Since August 2020, due to this crossover Nifty50 had entered a bullish trend which had lasted for over 1 year time period We could look at the 50-day and 200-day moving averages of the Sensex and watch for a golden crossover. This could encourage investors to buy stocks and drive-up prices.įor example, consider NIFTY50 chart (August 2020), If the 50-day moving average crosses above the 200-day moving average, it could indicate a potential upward trend in the market. This is considered a bullish signal, suggesting that the stock or market is trending upward. In this section we will be covering the crossover system for SMA and EMA respectively and how traders use this to take their tradesĪ Golden crossover is a technical analysis indicator that occurs when a short-term moving average (50-day moving average) crosses above a long-term moving average (200-day moving average). So after calculating the Weight current & Weight ma one can simple plug the values of Data Day I and Simple moving average of the day before to get the EMA value. So to calculate the 19 day EMA we use the following, Weight current = 2/ (number of days in moving average + 1) Here Data Day i is nothing but the closing price of the stock at that day. The commonly used EMA by technical analysts are 5,9,21,50,100,200ĮMA = Weight current X Data day i + Weight ma X Moving Average day i-1, If you notice, the 200 EMA is closer to the Nifty price as compared to the 200SMA Because of its unique calculation, EMA will follow prices more closely than a corresponding SMA. However, whereas SMA simply calculates an average of price data, EMA applies more weight to data that is more current. Also going ahead, we can also see that 50 day moving average (red line) has provided crucial resistance which Nifty has not managed to cross.Įxponential Moving Average (EMA) is similar to Simple Moving Average (SMA), measuring trend direction over a period of time. If you notice, Nifty50 gave a breakout once it crossed 50 day moving average after taking support at 200 day moving averages. The price of the index has taken support and resistance at every moving average and a break on either side has resulted in a breakdown or breakout. Let us understand this in a more simplified chartĬonsider multiple Moving average for Nifty50, Whenever the price is below the moving average, the moving average acts as a resistance and whenever the price is above the moving average it will as act as a support. Let us understand this by example, we will be using 50, 100 and 200 day simple moving averages for now. The moving averages are mainly used to determine support and resistance by the analyst. While calculating this number we are mainly moving to the latest data point hence the name “moving” average If you notice the average on 3 nd February 2023 and 6 th February are different.

Going ahead the next 5 day average for Nifty50 will be taken from the next trading session i.e to

Hence the moving average of Nifty50 in last 5 session is 17,736.21 Let us consider and calculate the moving average of last 5 days of Nifty50

For example, a 20day simple moving average is nothing but the arithmetic mean of the 20 day closing price of the stock, similarly for 50day, 100 day and 200 day respectively. To calculate the moving averages, we take the average of the closing price for those number of days. The most used simple moving average is the 20day, 50day, 100day and 200day moving average respectively The moving averages helps to eliminate the noise and gives a smooth data set for an analyst to take better trade decision. The price of a stock often fluctuates and can create a lot of noise for an analyst. The moving average is one of the oldest tools used by technical analysts.

0 kommentar(er)

0 kommentar(er)